option to tax unit

HMRC has adopted a 6 week trial starting at the end of May 2022 but not widely publicised during which it will issue a letter acknowledging receipt of an option to tax. Section 1256 options are always taxed as follows.

Stock A Has A Beta Of 1 Course Assignment Stock A Has A Beta Of 1 Stock B S Beta Is 1 And Studocu

The date the extended time limit for notifying an option to tax land and buildings applies to has been extended to decisions made.

. This means that many property owners will have sent their option to tax elections to. This is a six week trial being run by HMRC Option to Tax Unit that seems likely to affect how. The relevant form to send to HMRCs Option to Tax Unit in Glasgow is VAT1614A which means that the landlord does not need HMRCs permission to opt because he has not.

In Gerald Edelmans recent edition of The Property Round we outlined a trial being carried out by the Option to Tax Unit OTTU. Option to Tax National Unit Cotton House 7 Cochrane Street Glasgow. As a tip to finding out the progress of your application it might be worth emailing the Option to Tax Unit at optiontotaxnationalunithmrcgsigovuk.

This rule means the taxation of profits and losses from non-equity options are not affected by how long you hold them. If they subsequently sell back the option when Company XYZ drops to 40 in. The date the extended time limit for notifying an option to tax land and buildings applies to has been extended to decisions made between 15 February 2020 and 31 March.

Although an HMRC acknowledgment is not legally required for an Option to Tax to take effect it typically provides comfort on the VAT position for lawyers dealing with property. In order to make a successful option to tax election a taxpayer must go through two hurdles as set out in VAT Notice 742A paras 41 and 42. Input tax and the option to tax.

Put options receive a similar treatment. Where all of the following apply. Delays can jeopardise transactions given.

VATLP22590 - Option to tax. Before input tax can be deducted the taxpayer must have a clear intention to. HM Revenue and Customs Option to Tax National Unit 123 St Vincent Street GLASGOW G2 5EA Phone 0300 200 3700 Scanned copies of this form can be e-mailed to.

Taylor purchases an October 2020 put option on Company XYZ with a 50 strike in May 2020 for 3. The decision There will be a. Having included the wrong Wolverhampton address in their revised VAT notice 742A and notification form VAT1614 HMRC have now clarified that the correct new address for.

The option to tax rules have been with us a long time since 1 August 1989 to be exact. One unit is occupied by T3 a bank which has financed Ds construction work. Historically the OTTU have made extensive.

An option to tax may be disapplied in either of the following circumstances. An Option to Tax arises only with commercial property or land and when you decide to sublet it or sell it on. Obtaining acknowledgement of an option to tax OTT can be crucial to property deals and transfers of going concerns in particular.

Input tax incurred in anticipation of an option to tax. Changes are being trialled to how HMRC acknowledge an Option to Tax OTT.

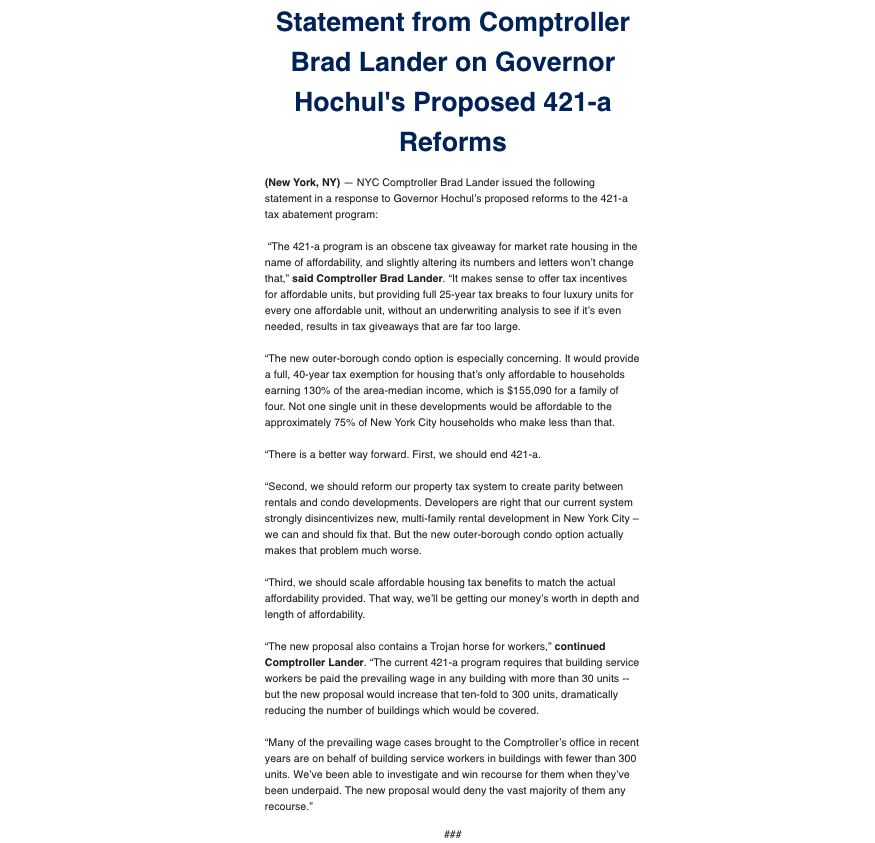

Comptroller Brad Lander On Twitter The 421 A Program Is An Obscene Tax Giveaway For Market Rate Housing In The Name Of Affordability And Slightly Altering Its Numbers And Letters Won T Change That

Non Us Spouse Tax Strategies For Us Expats Married To Non Us Citizens

Stock Based Compensation Back To Basics

Mayes Middleton Chambers County Commissioners Court Has Facebook

Restricted Stock Units Rsus Facts

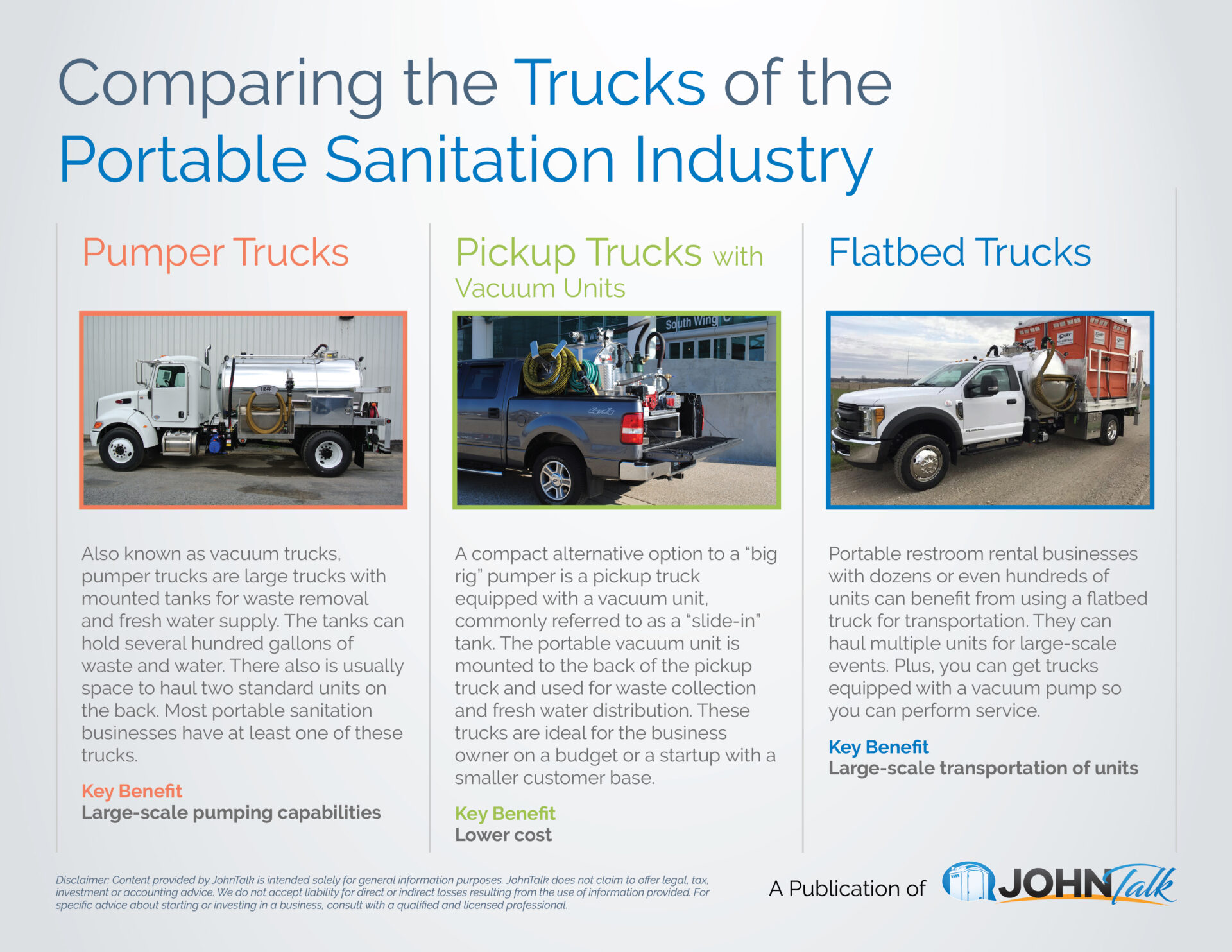

Infographic Comparing The Trucks Of The Portable Sanitation Industry Johntalk

Vat The Option To Tax Or Not To Tax Depledge Strategic Wealth Management

4 7 Taxes And Subsidies Principles Of Microeconomics

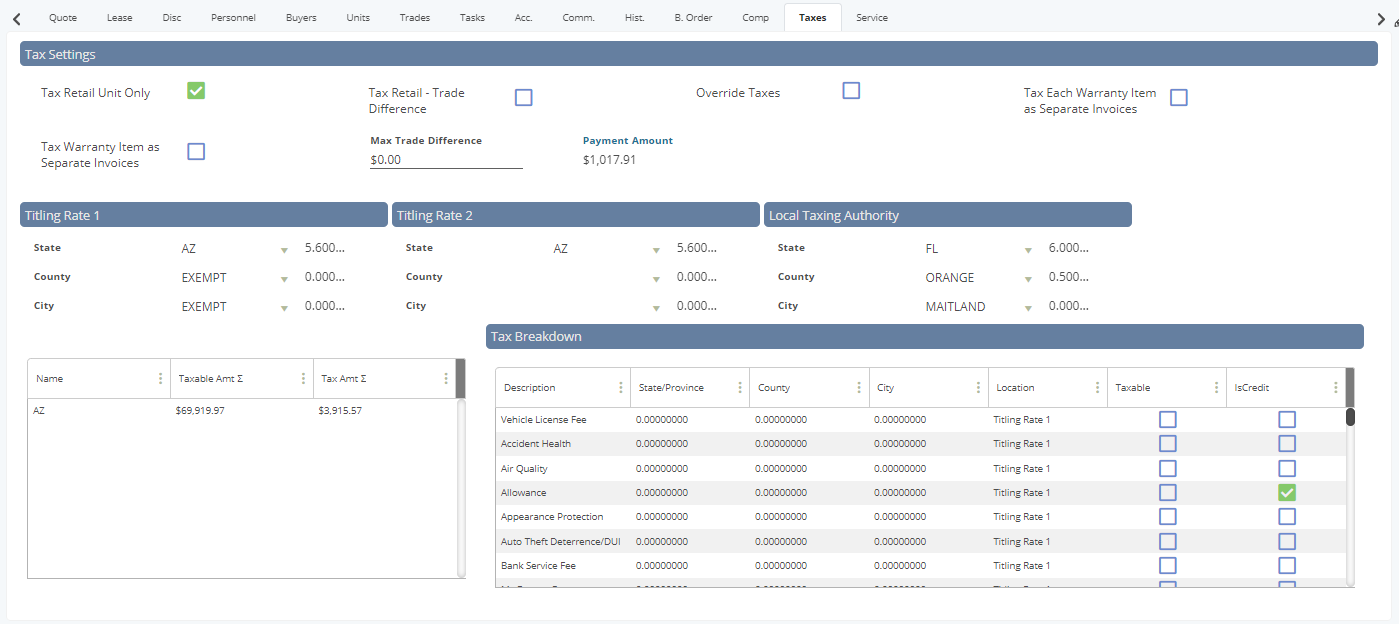

Enable And Create Tax Unit Excise For Dealer

Edgar Filing Documents For 0001193125 19 050047

State And Local Tax Collections State And Local Tax Revenue By State

Solved Option A Two Months Ago Ssf Paid An Chegg Com

What Is A Tax Liability Ramseysolutions Com

Request A Certificate Of Clean Hands At Mytax Dc Gov Mytax Dc Gov

Low Income Housing Tax Credit Could Do More To Expand Opportunity For Poor Families Center On Budget And Policy Priorities

Publication 970 2021 Tax Benefits For Education Internal Revenue Service

/dotdash_Final_Net_of_Tax_Dec_2020-98efd407350341fdb178949dadd84c5c.jpg)